In addition, active income includes earnings through self-employment or materially engaging in a business and being compensated.Īctive income must be obtained before passive income can be generated for most individuals.

PASSIVE INCOME VS ACTIVE INCOME FULL

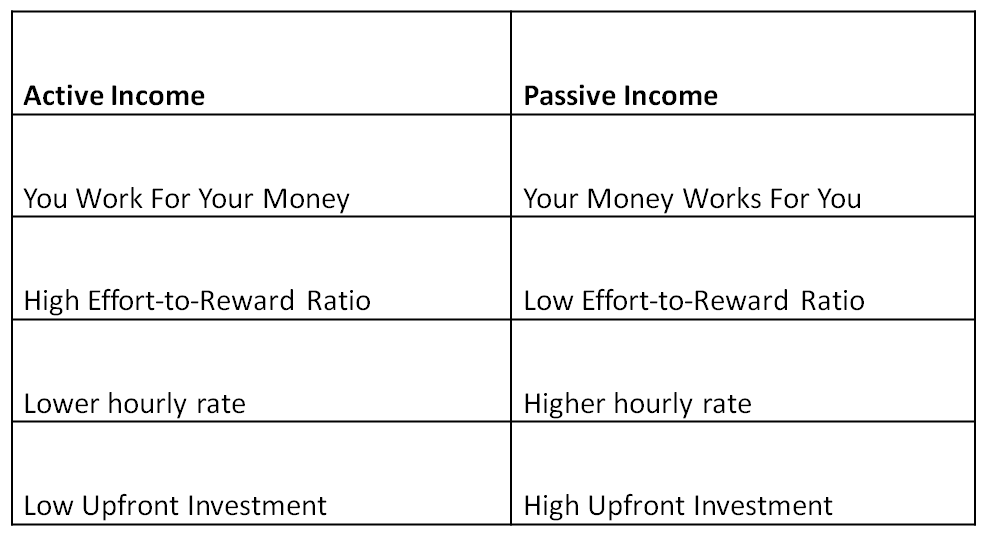

Having a full or part-time job and earning a wage, commissions, or bonuses is an example of active income. Passive Income vs Active Income: The Difference

PASSIVE INCOME VS ACTIVE INCOME HOW TO

In addition, we’ll help you discover the world of passive income and how to excel at it through a wide range of real estate strategies. Therefore, before we go further in this article, let’s solve the two obvious questions: what is the difference between passive and active income, and how to define passive income? Furthermore, while you may have heard these two terms before, many people aren’t sure what they mean. Want to learn more? Sign up here and someone from my team will be in touch.Whatever method you use to earn money, your earnings will fall into two groups: passive income or active income. So basically, you can invest, and my team and I will do all the work. The Scott McGillivray Real Estate Fund gives people an opportunity to invest passively alongside me in a portfolio of residential development projects in key growth areas in Southern Ontario. Each project was strategically selected by me, and my qualified team of real estate professionals, to offer investors an attractive return. I’m such a big fan of this type of passive investing opportunity that I started my own fund.

These entities pool capital from investors into a diversified portfolio of real estate opportunities and usually deliver a very attractive return Real Estate funds are professionally managed investment vehicles. One of the most popular methods, and one that I’m particularly interested in, is real estate funds. With that said, there are ways to passively invest in real estate that require almost no work from the investor, and these types of investments are fantastic for those who want the benefits real estate can provide without any of the responsibilities. This is why it tends to get lumped into the passive category.

However, once it’s rented the money will keep landing in your bank account whether you spend time actively working on the property or whether you take time off. With rental properties, you have to purchase the property, get it ready for renters, do some regular maintenance, manage the tenants, and so on. The term “passive income” is a little bit misleading when it comes to real estate investing because – especially with rental properties – there is quite a bit of work required to start earning that income. I’m being a bit flip, obviously, but put it this way – I’ve never once called in sick to one of my rental properties! Passive Income in Real Estate Investing If you can take some time off with no one noticing, it’s likely passive income. This could be investment income, residual payments from a previous job, royalties you earn on something you created and so on.Īn easy way to look at it is if you have to call in sick you’re probably making active income. Passive income is different in that you are earning money from something that you have little day-to-day involvement in. If you have a traditional job you’re more than likely earning active income. So this could include your salary, any commission you might make, tips, etc. Here’s the way I see it.Īctive income is what comes from performing a task in exchange for money. In order to understand how, you first have to understand the difference between active income and passive income. People often refer to the money you make from real estate investing as passive income.

0 kommentar(er)

0 kommentar(er)